Rangarajan panel on road developers bailout to be set up soon

October 18, 2013

New Delhi: The government will soon constitute a panel, headed by PMEAC Chairman C Rangarajan, to look into the issues pertaining to bailout of highway developers.Rangarajan, who heads the Prime Minister’s Economic Advisory Council, is expected to announce the constitution of the three-member panel soon, a source told the agency, adding that it could be as early as Thursday.

The government last week approved a proposal for the postponement of premium payments by highway developers and has referred the matter to the Rangarajan panel.

The move is likely to provide relief to players such as GMR, GVK and Ashoka Buildcon. Their projects have been facing delays on account of high premium — the payment made by the developer to National Highways Authority of India under the build, operate and transfer (BOT) mode.

The premium, which is offered by companies during the bidding stage, is based on projected returns from tolls.

The Ministry of Road Transport and Highways had sent a proposal to the Cabinet seeking its nod for rescheduling of premiums of about Rs 1 lakh crore in case of 23 awarded BOT (Toll) projects.

Bailout package should not be like flawed exit policy: National Highway Builders’ Federation

October 16, 2013

YASHODHARA DASGUPTA, ET Bureau

NEW DELHI: A week after the government approved a bailout of the highways sector and set up a committee that will draft its details, developers told Prime Minister Manmohan Singh that the rescue plan shouldn’t end up being similar to what they described as the “flawed exit policy” that has failed to attract takers.

The committee headed by C Rangarajan, chairman of the Prime Minister’s Economic Advisory Council, is expected to give its recommendations on the premium restructuring in a month. The final decision will be implemented by the highways ministry after it is approved by finance minister P Chidambaram.

“The guidelines for the rescheduling of the premium for the highway projects are required to address the concerns raised by the sector as a whole, otherwise it will not only defeat the purpose of the policy but also not help in the revival of the road sector,” the National Highway Builders’ Federation (NHBF) said in its letter to Singh. “In the past it is a known fact that because of the flawed exit policy for the road sector announced by the government, it has not been able to attract even a single investment.”

The road developers sought a reduction in costs they have to pay for deferring the premium. According to the Cabinet note sent by the highways ministry, which included suggestions of the finance ministry and the Planning Commission, developers need to pay 12 per cent on the premium as well as a penalty of up to 0.5 per cent of the total project cost in case the default was attributed to them. The concessionaires would also have to give a bank/corporate guarantee to the extent of the maximum difference between the premium promised at the time of bidding and that under the revised payment schedule, according to the cabinet note.

The NHBF letter, also sent to Chidambaram, Rangarajan and roads minister Oscar Fernandes, argued that deferral of premium payments should be allowed at a 9.75 per cent discount rate, the rate at which Cabinet last year allowed telecom operators to stagger spectrum fee payments. NHBF explained that “the proposal of highway sector’s deferment of premium is similar to telecom sector on contract terms and conditions on period of contract and cost involved…”

“A case for some form of relief can be made and the 12 per cent rate needs a relook in the current context.The situation in some sense is similar to the telecom sector relief because they too were going through stress at the time,” said Arvind Mahajan, partner at KPMG, who added that both sides needed to make some sort of concessions. “Many companies involved in projects are highly leveraged. They are also facing execution challenges because of delays on part of NHAI and escalation in project cost,” Mahajan said.

NHBF has argued against the penalty clause saying the viability of most of these projects were eroded because of delays in environmental clearance, land acquisitions, a ban on the procurement of aggregates and so on. NHBF has also opposed the corporate or bank guarantee clause saying most concessionaires are either undergoing corporate debt restructuring and are over-leveraged or bankers are not willing to lend to them.

Source-http://articles.economictimes.indiatimes.com

Roads: clearing obstacles will take time

October 15, 2013

Vatsala Kamat

(The government’s desire to give a push to infrastructure projects may result in some relief from the problems of poor order inflows and low financial viability of existing projects. Photo: Ramesh Pathania/Mint)

Last week’s decision by the government to reschedule the premium payable by developers to the National Highways Authority of India (NHAI) is aimed at giving jammed road projects a new lease of life. The decision to reschedule the premium arose out of the fact that many developers quoted a hefty premium to win orders, as competition increased between fiscal years 2012 and 2013, which led to some projects turning financially unviable.

No doubt, the decision to reschedule will not change the profile of projects overnight. Analysts’ data indicates that more than 80% of the build-operate-transfer (BOT) projects awarded in fiscals 2012 and 2013 have not started construction yet. It is now widely known that land acquisition and environmental clearances, highly leveraged balance sheets, poor cash flows on existing projects and high interest rates are key reasons for a slowdown in the roads sector.

Around 23 projects caught in a quagmire will be examined on a case-to-case basis. However, a note by Citi Research says that one of the conditions to ensure smooth payments by developers after rescheduling is that the firms should furnish bank guarantees. “Given the tightening lending standards to road projects and leveraged balance sheet of developers, it may be difficult to furnish the bank guarantee,” it says.

As has been the case during the past several quarters, the September quarter too will see earnings of most infrastructure firms including roads being weighed down by high interest and depreciation costs. A report by IDBI Capital Market Services Ltd expects companies such as Hindustan Construction Co. Ltdand IVRCL Ltd to be in the red during the September quarter. And, others such as Simplex Infrastructures Ltd, Nagarjuna Construction Co. Ltd and IRB Infrastructures Developers Ltd are likely to see a decline in earnings compared to the year-ago period. Revenue expansion is likely in some cases where execution is on track.

But analysts’ data reveals that against a normal road completion time of 48 months, most projects awarded in fiscal 2009-10 are complete to the extent of only 50-60%.

Complicating the imbroglio is the fall in order inflows, which could get worse in the near term, given that elections typically see major decisions being postponed. This would stymie revenue expansion too. This fiscal year till date, NHAI has awarded only 479km of road projects costing Rs.2,700 crore, compared to the road ministry’s target of 5,000km of both EPC and BOT projects. EPC stands for engineering, procurement and construction.

Now, the orders that have already been given can mean healthy order book for some firms, giving decent revenue visibility for the next one or two years. Among the mid-sized firms, Sadbhav Engineering Ltd and Ashok Buildcon Ltd are better off than some of their peers.

The government’s desire to give a push to infrastructure projects may result in some relief from the problems of poor order inflows and low financial viability of existing projects. But the pace leaves a lot to be desired and it may be many more quarters before actual and substantial movement is visible. For now, nothing seems to have changed for the roads sector.

IVRCL to sell assets including Chennai Desalination Plant and Jalandhar-Amritsar Highway project

October 10, 2013

By PTI |

“Three parties have been showing interest in the desalination plant, but numbers are yet to come from them. No agreement has been signed yet, but the process has begun,” Reddy said, answering a shareholder’s query at the company’s annual general meeting yesterday.

The Chennai desalination plant, with a capacity to purify 100 million litres of sea water everyday, was set up at an investment of Rs 600 crore in 2010.

Recently, IVRCL sold three highway projects it developed on NH-47 in Tamil Nadu to Tata Group company TRIL Roads Pvt Ltd (TRPL) in a bid to reduce debt in its books which were denting profits.

Reddy said the company’s debt would be reduced by Rs 1,100 crore, besides getting back around Rs 450 crore of its equity invested in road projects.

IVRCL has a consolidated debt of around Rs 6,100 crore as on March 31, a senior company official said.

The company suffered a Rs 102-crore loss during FY 2013 on gross turnover of Rs 3,579 crore due to high interest and finance costs pegged at Rs 348 crore during the fiscal.

“In nine months, we are hopeful of selling assets. We will not bid for any BOT projects till the interest regime is stable,” he said, about the time frame for the second round of sales.

Three road projects already sold by IVRCL include Salem toll way, Kumarapalayam toll way and IVRCL Chengapally toll way, which is being built on a build-operate-transfer (BOT) basis at a cost of Rs 2,200 crore, IVRCL said earlier.

IVRCL is also working on some more BOT road projects which will reach their final stages in six months, Reddy said.

The 155-km Indore-Jhabua road project will be ready in next six months and become operational, he said.

The company also plans to commence commercial operations of its Baramati-Phaltan road project in Maharashtra, Reddy said.

Government revisiting policy that allows infrastructure developers to exit highway projects

October 10, 2013

By ET Bureau |

“The policy has not found many takers and we are currently revisiting the framework to resolve issues over taxation in the Special Purpose Vehicles ( SPV) executing the projects,” said Rohit Kumar Singh, joint secretary with the ministry of road transport and highways. There is confusion over whether tax holidays and other aspects of the policy would apply when the new developer comes in, he said.

Highway developers had written to the government after the policy was formalised, saying it was unclear whether tax benefits could migrate to the new entity and that capital gains tax implications could also be substantial. They had also stated that clarity was needed on whether legal consents and permits could migrate to the new entity.

The ministry also wants more flexibility in the model concession agreement (MCA) to allow the National Highways Authority of India (NHAI) board to make changes, if required.

“Currently, the MCA is a very rigid framework. Even for small changes we need to go the Cabinet which takes time and it needs to be justified on several levels. The MCA should be left to the NHAI board to decide and this includes the framework of how Public Private Partnerships (PPP) will be required to be addressed in the road sector,” Singh said while addressing a PHD chamber conference on infrastructure.

“Under the framework designed by the committee headed by Planning Commission member BK Chaturvedi, any road project will have to be tried first on the Build-Operate-Transfer (BOT) – toll model. If it does not succeed, go BOT (annuity), and if still does not succeed go to the Engineering Procurement and Construction ( EPC) model. This leaves no flexibility for new, innovative models which might be appropriate considering the field conditions,” Singh added.

Salem-Ulunderpet road cuts travel time by half

September 12, 2013

By Express News Service -

The widening of 136-km stretch between Salem and Ulunderpet had been completed and collection of toll has begun, said Reliance Infrastructure Limited which executed the project.

The project, executed on the Build-Operate-Transfer (BOT) pattern, under the aegis of the NHAI, was awarded to RInfra to operate and maintain for a concession period of 25 years.Built at a cost of Rs 1,061 crore, the Salem- Ulunderpet corridor connects major tourist destinations and industrial zones in Salem district with Chennai International Airport. Sudhir R Hoshing, CEO (Roads), Reliance Infrastructure, said, ‘‘The Salem- Ulundurpet road will provide a hassle-free, safe and smooth driving experience.’’

Source-http://www.indianexpress.com

NCC Limited to sell BOT assets to reduce debt

September 11, 2013

Prashanth Chintala |

NCCL is also reported to have decided to exit from the two joint venture power projects in which it had made investments

Hyderabad-based NCC Limited (NCCL) has decided to sell some of its build, operate and transfer (BOT) assets and other properties, including land parcels, to bring down debt on the company’s books.

The BOT assets of the infrastructure development company include five road projects, which have commenced commercial operations.

“We are looking at a strategic sale of two road projects and some real estate assets to reduce our debt, which is to the tune of Rs 2,225 crore,” company’s executive vice president (finance), YD Murthy, told Business Standard.

He said the company was currently holding discussions with potential buyers for the sale of two toll projects located in western Uttar Pradesh and Karnataka. He was expecting the sale proceeds would be Rs 200-250 crore.

NCCL is also reported to have decided to exit from the two joint venture power projects in which it had made investments. While it is stated to have sold a 5 per cent stake in the 100-Mw Himachal Sorang Power Limited, discussions are being held with interested company’s for a stake sale in the 1,320-Mw coal fire project at Krishnapatnam in Andhra Pradesh.

According NCCL managing director AAV Ranga Raju, the company expects a 10-15 per cent growth in both order book and topline in 2013-14. It had already received fresh order of Rs 4,814 crore.

NCC had achieved a consolidated turnover of Rs 7,059 crore and a net profit of Rs 56.38 crore in 2012-13. Finance costs during the year stood at Rs 595 crore.

Despite the challenging environment, Raju stated in NCC’s annual report that the company registered a 9 per cent rise in topline last year due to a reduction in establishment expenses and improvement in project execution and collections.

In the current financial year, NCC reported a 71 per cent decline in its net profit to Rs 5.8 crore for the first quarter as compared with a profit of Rs 20.33 crore in the corresponding quarter last year.

IVRCL to exit from all BOT projects

August 16, 2013

Prashanth Chintala | Chennai/ Hyderabad

The company has 11 BOT projects of which, one is water and 10 are road projects

Hyderabad-based infrastructure company IVRCL Limited has decided to exit from all its build, operate and transfer (BOT) projects and focus on engineering, procurement and construction (EPC) activities.

At present, the company has 11 BOT projects of which, one is water and 10 are road projects. Of the 10 road projects, three projects are under operation and three more are expected to come under operation in the next five months, while the remaining four are still in a virgin stage.

“We have invested over Rs 2,000 crore in the six road assets and this amount will come into our kitty if I exit from them. Consequently, my profitability will go up,” IVRCL chairman and managing director, E Sudhir Reddy, said.

He said the amount realised from the sale of the six assets could be utilised for the companies EPC segment which has an order book of Rs 26,000 crore at present.

The road projects of the company, which are currently under operation, are Salem Tollways (53.53 km), Kumarapalayam Tollways (48.51 km) and Jalandar Amritsar Tollways (49 km).

“We will sell these three toll projects first while the other three projects which are under construction will be offered for sale after they are completed,” Reddy said.

Though the three toll projects have been put on the block for nearly a year, he said no deal had been finalised so far. Three firms, including Tata Realty and Infrastructure, have evinced interest in the projects but “nothing had been finalised till now.”

According to Reddy, infrastructure companies that have taken up road projects on a BOT basis have failed in their traffic assumptions and anticipation of interest rate hikes and dollar fluctuations. The execution of many projects has been delayed on account of various aspects including lack of environmental and forest clearances. Consequently, “95 per cent of the contractors who had jumped into these projects have lost money.”

“If the BOT projects have to be viable, the government should increase the concession period by at least 3-10 years,” he said. At present, the concession period, depending upon the project location, ranged from 20 to 30 years.

Reddy denied reports that there was a delay in the execution of works pertaining to four/six laning of NH- 47 from Chengapalli, near Coimbatore, to Walayar on the Tamil Nadu-Kerala border due to funds shortage. “Work was slowed down because we are awaiting the state support agreement, which is part of the conditions of the contract. In the absence of such an agreement, bankers are not releasing any loans,” he said.

RITES to find out if ads can be displayed on FOBs

August 16, 2013

Joel Joseph, TNN |

Initially the MCG planned to construct the FOBs on build-operate-transfer (BOT) basis wherein the agency that would get the contract to build them would get rights to display advertisement on them for a specific number of years. However, following the high court order, the construction model had to be re-looked since the advertisements could no longer be installed.

Not willing to spend its own money, despite being cash rich, the MCG has now asked RITES to conduct a survey of all the 14 locations and report in which all spots the advertisements can be displayed without diverting the attention of the motorists or being a traffic hazard.

According to a source, depending on the report, if there are spots which are non-hazardous, the contract for these will be given on BOT basis and for the rest the MCG will spend its own money in constructing them.

The lack of foot over bridges in the city is leading to a rise in traffic accidents in the city. The latest data from the traffic police shows an increase in the pedestrian deaths as they are forced to brave traffic in order to cross the road. Out of the 14 locations that will have FOBs, the first is to come up on the old Delhi-Gurgaon road near the Delhi border.

BOT projects hit speed-bump

August 13, 2013

Plagued by the weak financial position of players, delays in project clearances and low estimated traffic density for many stretches on offer, BOT (build-operate-transfer) projects in the roads sector have hit a roadblock and severely dented the pace of development of road infrastructure in the country.

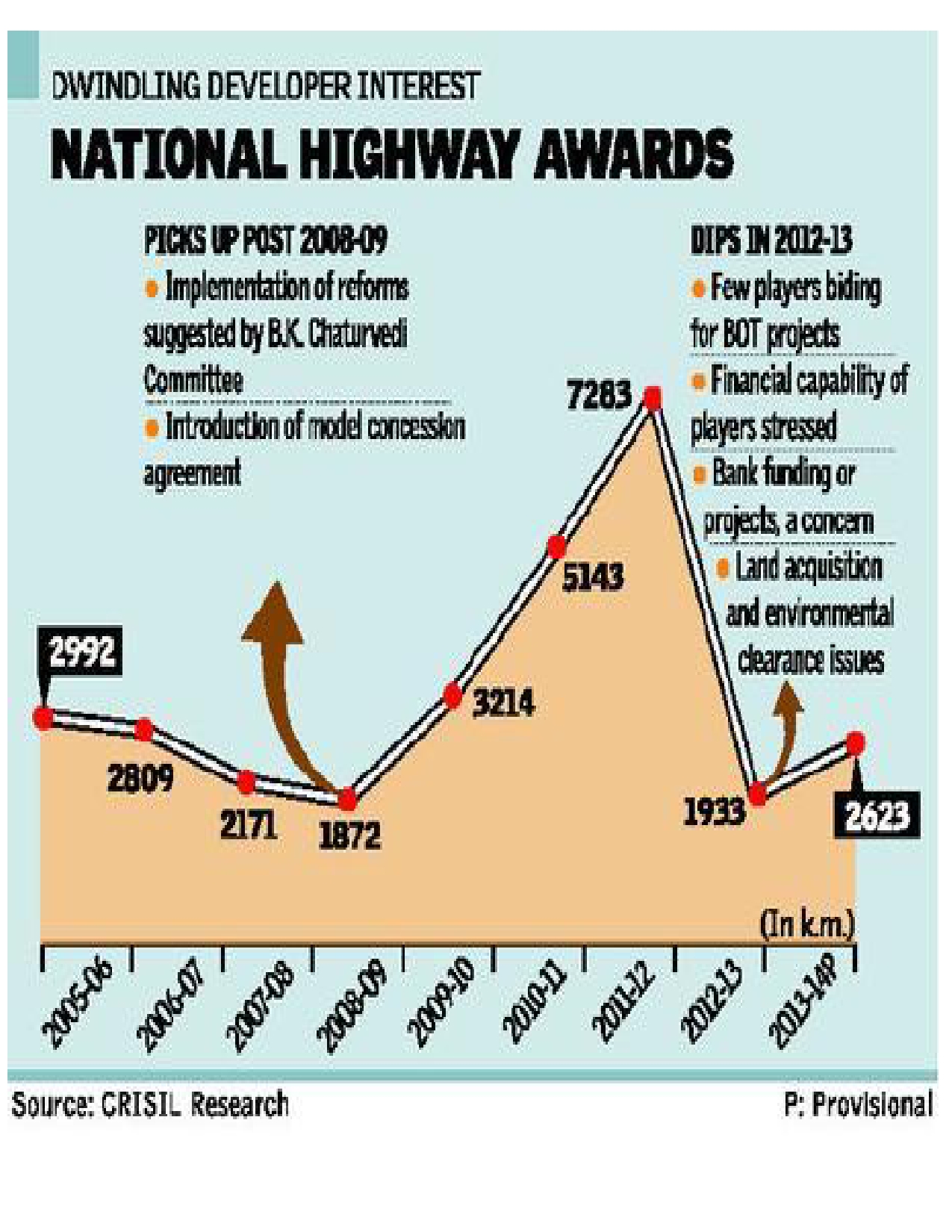

Dwindling developer interest in BOT road projects is mirrored in the fact that awarding for national highway projects slowed to an eight-year low of 1,933 km in 2012-13 (this includes awarding both by National Highways Authority of India and the Ministry of Road Transport & Highways).

Financial position

The financial condition of many players in the sector is so precarious that the situation is unlikely to improve drastically in the current year. We expect nearly 2,600 km of awarding in 2013-14; nearly 50 per cent of this will be part of Phase IV, which mostly involves low traffic density stretches.

Pertinently, most of the projects will be awarded on EPC (engineering, procurement and construction) basis, not BOT.

It is not just awarding that has suffered in the past year or so; project execution too has taken a beating. During 2011-12, awarding hit a 9-year high of 7,283 km, however, at least 25 projects involving 3,300 km of roads are currently stalled.

Of these 25 projects, about 60 per cent are held up due to land acquisition or environmental clearance issues while the rest are stuck due to the inability of companies to achieve financial closure. We don’t see things on the ground changing swiftly; project execution will remain flat around 3,500 km during 2013-14 also.

This slump in attractiveness of BOT projects is largely the outcome of aggressive bidding by developers a couple of years ago. Projects awarded in 2011-12 faced delays in achieving financial closure as many players had bid aggressively by quoting a huge premium amount, based on highly optimistic road traffic density estimates that have not subsequently fructified. These aggressive bids lowered the viability of these projects.

Consequently, the gearing of many players is now very high due to a sizable portfolio of BOT projects under implementation; average gearing in companies in roads-BOT segment is 3.1 times as of 2012-13. Saddled with such high gearing, players have limited financial flexibility to bag more BOT projects. This was compounded by NHAI’s offer of relatively less attractive road projects in 2012-13, where traffic density, and thus, potential to make good returns was lower. The net result was a poor turnout of players for bidding.

Bank funds

Today, obtaining funds from banks is an even more arduous task for developers. Banks have become more cautious while lending to road projects since many of them are approaching their sectoral exposure limit towards the roads sector. In addition, banks are trying to ensure that land acquisition does not cause delays in the project.

Therefore, they are demanding that 80-100 per cent of the land be available with the developer at the time of awarding (typically, 40-50 per cent land is made available by NHAI at the time of awarding).

Many projects faced delays in getting environmental clearance and forest clearance, which added to the players’ discomfort and discouraged them from bidding for new projects. In the recent past, GMR and GVK filed for termination of two large BOT projects (awarded in 2011-12) citing delays in the allotment of land and clearances from NHAI.

The fall from favour of BOT projects among developers has left NHAI with little choice but to award more projects through the EPC route. EPC projects entail limited upfront capital requirement and lower risk compared to BOT projects, so player interest in them will remain high.

EPC route

Over the next 12-18 months, we expect most of the road projects to be awarded through the EPC route. This will boost the share of EPC projects in total investments to about 40 per cent in the next five years from 28 per cent in the past five years.

For the BOT road projects to pick up, funding availability needs to improve. While the government has tried to address this through steps such as relaxation of exit norms, in the current scenario these measures may not be enough. Developers on their part need to actively look at stake sale in operational BOT projects and at the same time look at equity infusion. While the implementing body and the project developers look at course correction, the road to recovery is expected to be some way off. Over the next couple of years both awarding as well as implementation is expected to remain subdued.

source: http://www.thehindu.com