MoRTH declares 17 applicants non-responsive

September 18, 2013

Posted by PM News Bureau

The Ministry of Road Transport and Highways (MoRTH) has released the list of applicants found non-responsive in the annual pre-qualification process (RFAQ 2013) initiated in the month of May for national highway projects to be implemented in the Engineering, Procurement and Construction mode.

The Ministry of Road Transport and Highways’ list contains a total of 17 applicants who were non-responsive. Such applicants had failed the test of responsiveness as mentioned in the Request for Qualification document because of either not applying in the prescribed format along with supporting documents or failing to file the application online or lack of adherence to the requirement of submitting hard copies of necessary documents.

The applicants declared non-responsive have been informed that they could again apply for annual pre-qualification under Part II of RFAQ 2013 to participate in the bid process of individual national highway projects slated for implementation in the EPC mode through the MoRTH/National Highways Authority of India/state Public Works Departments/Border Roads Organisation.

The MoRTH has already invited applications from individual entities as well as joint ventures for annual pre-qualification under Part II of RFAQ 2013. The application for annual pre-qualification is required to be submitted online by September 17th, 2013. The physical submission of necessary documents has to be ensured by September 24th, 2013.

As in RFAQ 2013, the objective of Part II would be to evaluate, pre-qualify and register the eligibility limit of applicants. The applicant needs to indicate the upper limit of his eligibility for which he wishes to get pre-qualified in the application. At the end of the exercise, the MoRTH would announce the applicant’s pre-qualification with eligibility limit in financial terms. Thereafter, the applicant can bid for projects whose Estimated Project Cost falls within the pre-qualified eligibility limit. Once pre-qualified, there is no need to submit detailed application at the Request for Proposal stage of each project. The eligibility limit of the applicant would be declared as on September 17th, 2013, with the pre-qualification valid till June 30th, 2014. Applicants left out or those wanting to update the eligibility limit, with validity up to June 30th, 2014, could apply online from November 1st till November 18th, 2013. Applicants already successful under RFAQ 2013 do not need to apply again.

Highways Ministry declares eligibility limit of conditionally qualified applicants under RFAQ 2013

September 18, 2013

Posted by PM News Bureau

The Ministry of Road Transport and Highways recently declared the eligibility limit of 34 conditionally qualified applicants who had sought annual pre-qualification under RFAQ 2013 for national highway projects to be implemented in the Engineering, Procurement and Construction mode.

Applications for annual pre-qualification under RFAQ 2013 were invited in May this year. The eligibility limit (as on July 5th, 2013) declared by the MoRTH is valid till June 30th, 2014. The national highway projects in EPC mode would be implemented through MoRTH/National Highways Authority of India/state Public Works Department/Border Roads Organisation.

As per the list of the 34 conditionally qualified applicants, the eligibility limit of seven exceeds Rs. 1,000 crore. The applicants conditionally qualified for eligibility limit above Rs. 1,000 crore are Sadbhav Engineering Limited (Rs. 3,161.55 crore), Galfar Engineering and Contracting SAOG (Rs. 2,054.09 crore),Hindustan Construction Company Limited , Punj Lloyd Limited (Rs. 1,295.18 crore), Modern Road Makers Private Limited (Rs. 1,182 crore) IVRCL Limited (Rs. 1,144.78 crore) and KMC Constructions Limited (Rs. 1,080 crore). Another seven applicants have been conditionally qualified for eligibility limit ranging between Rs. 500 crore and Rs. 1,000 crore. The rest are conditionally qualified for eligibility limit below Rs. 500 crore.

The MoRTH had evaluated the eligibility limit of the conditionally qualified applicants based on their submission in the application. Such applicants can bid for projects whose Estimated Project Cost falls within the pre-qualified eligibility limit. Once pre-qualified, there is no need to submit detailed application at the Request for Proposal stage of each project.

Earlier, a total of 17 applicants were declared non-responsive under RFAQ 2013.

The 12th Five Year Plan envisages construction of 20,000 km. two-lane national highways in the EPC mode.

Source-http://www.projectsmonitor.com

BOT projects hit speed-bump

August 13, 2013

Plagued by the weak financial position of players, delays in project clearances and low estimated traffic density for many stretches on offer, BOT (build-operate-transfer) projects in the roads sector have hit a roadblock and severely dented the pace of development of road infrastructure in the country.

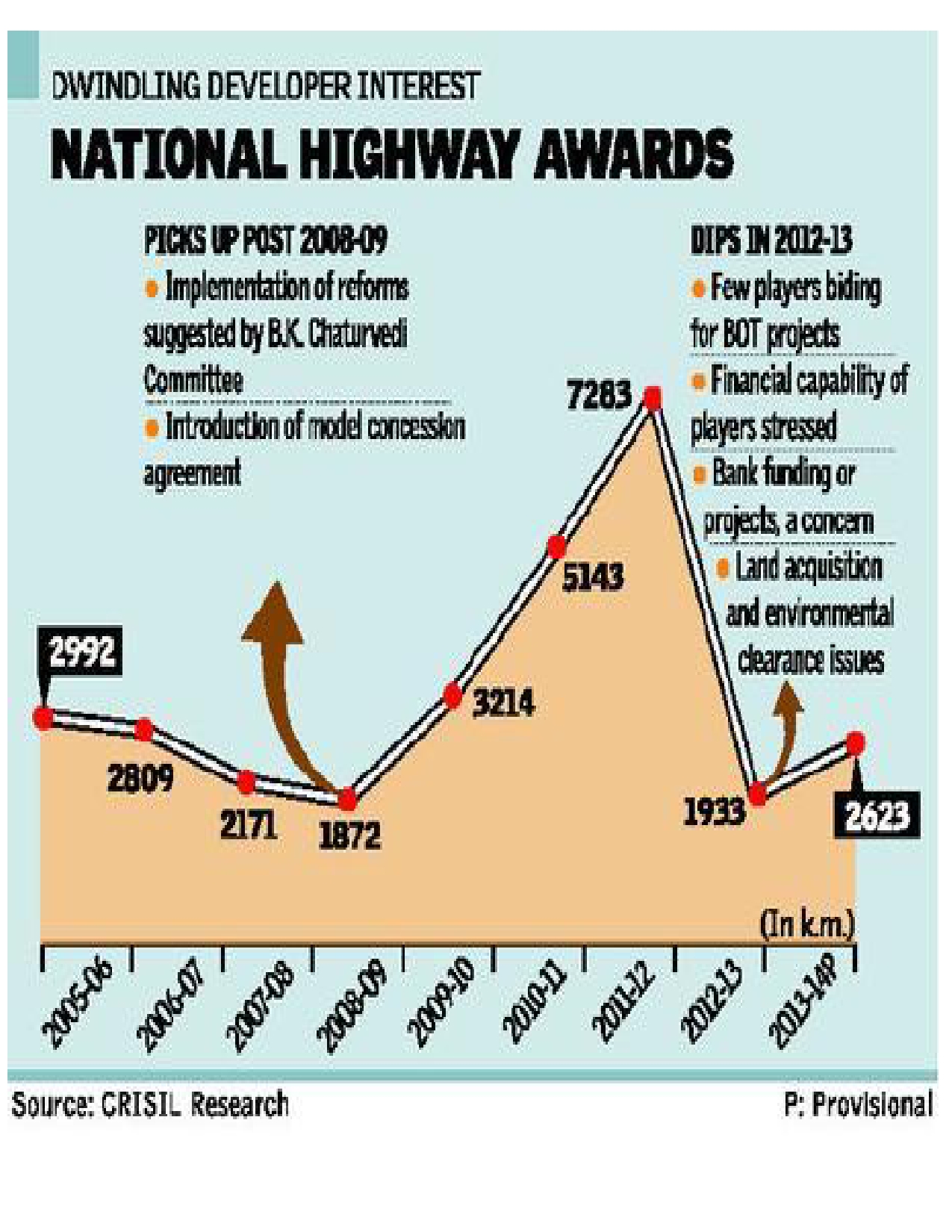

Dwindling developer interest in BOT road projects is mirrored in the fact that awarding for national highway projects slowed to an eight-year low of 1,933 km in 2012-13 (this includes awarding both by National Highways Authority of India and the Ministry of Road Transport & Highways).

Financial position

The financial condition of many players in the sector is so precarious that the situation is unlikely to improve drastically in the current year. We expect nearly 2,600 km of awarding in 2013-14; nearly 50 per cent of this will be part of Phase IV, which mostly involves low traffic density stretches.

Pertinently, most of the projects will be awarded on EPC (engineering, procurement and construction) basis, not BOT.

It is not just awarding that has suffered in the past year or so; project execution too has taken a beating. During 2011-12, awarding hit a 9-year high of 7,283 km, however, at least 25 projects involving 3,300 km of roads are currently stalled.

Of these 25 projects, about 60 per cent are held up due to land acquisition or environmental clearance issues while the rest are stuck due to the inability of companies to achieve financial closure. We don’t see things on the ground changing swiftly; project execution will remain flat around 3,500 km during 2013-14 also.

This slump in attractiveness of BOT projects is largely the outcome of aggressive bidding by developers a couple of years ago. Projects awarded in 2011-12 faced delays in achieving financial closure as many players had bid aggressively by quoting a huge premium amount, based on highly optimistic road traffic density estimates that have not subsequently fructified. These aggressive bids lowered the viability of these projects.

Consequently, the gearing of many players is now very high due to a sizable portfolio of BOT projects under implementation; average gearing in companies in roads-BOT segment is 3.1 times as of 2012-13. Saddled with such high gearing, players have limited financial flexibility to bag more BOT projects. This was compounded by NHAI’s offer of relatively less attractive road projects in 2012-13, where traffic density, and thus, potential to make good returns was lower. The net result was a poor turnout of players for bidding.

Bank funds

Today, obtaining funds from banks is an even more arduous task for developers. Banks have become more cautious while lending to road projects since many of them are approaching their sectoral exposure limit towards the roads sector. In addition, banks are trying to ensure that land acquisition does not cause delays in the project.

Therefore, they are demanding that 80-100 per cent of the land be available with the developer at the time of awarding (typically, 40-50 per cent land is made available by NHAI at the time of awarding).

Many projects faced delays in getting environmental clearance and forest clearance, which added to the players’ discomfort and discouraged them from bidding for new projects. In the recent past, GMR and GVK filed for termination of two large BOT projects (awarded in 2011-12) citing delays in the allotment of land and clearances from NHAI.

The fall from favour of BOT projects among developers has left NHAI with little choice but to award more projects through the EPC route. EPC projects entail limited upfront capital requirement and lower risk compared to BOT projects, so player interest in them will remain high.

EPC route

Over the next 12-18 months, we expect most of the road projects to be awarded through the EPC route. This will boost the share of EPC projects in total investments to about 40 per cent in the next five years from 28 per cent in the past five years.

For the BOT road projects to pick up, funding availability needs to improve. While the government has tried to address this through steps such as relaxation of exit norms, in the current scenario these measures may not be enough. Developers on their part need to actively look at stake sale in operational BOT projects and at the same time look at equity infusion. While the implementing body and the project developers look at course correction, the road to recovery is expected to be some way off. Over the next couple of years both awarding as well as implementation is expected to remain subdued.

source: http://www.thehindu.com

Errant road builders may have to pay fine to exit project

August 12, 2013

PTI

(“If there is any fault on…)

NEW DELHI: Road developers will not be blamed for delays in regulatory procedure but have to take responsibility for their own faults and may have to pay up to 1 per cent of total project cost as penalty for exiting, Road Minister Oscar Fernandes said.”If there is any fault on the part of the concessionaire, then there will be a penalty of a maximum of one per cent, of the total project for the developer to exit the project,” he told PTI.

The government is also of the view that the developer will not be held responsible if there is any kind of delay in regulatory procedure.

“If there is delay in land acquisition or environment and forest clearance, the concessionaire will not be held responsible…in that case they will not be penalised,” Fernandes said.

The Ministry of Road Transport and Highways is believed to have firmed up this clause after consultation with the Law Ministry.

Last month, the government approved the proposal to facilitate harmonious exit of the concessionaire in ongoing and completed National Highway Projects, a move aimed at expediting implementation of road infrastructure in the country. This was also done to insulate the National Highway Authority (NHAI) from heavy financial claims and unnecessary disputes.

The existing concessionaires both in case of completed and on-going projects have been permitted to divest their equity in totality.

The decision was triggered by lack of interest among bidders for highway projects under the PPP (public private partnership) mode and difficulties faced in achieving financial closure for such projects.

A large number of highways projects, including 20 major projects involving investment of Rs 27,000 crore, are stalled for various clearances.

Earlier this year, infrastructure players like GMR and GVK had recently walked out of mega road contracts while a large number of projects awarded during 2011-12 are yet to achieve financial closure.

The highway developers were facing acute shortage of equity and were unable to raise the required debt which in turn resulted in poor response to the PPP projects.

Meanwhile, the newly-appointed Road Minister also said that his challenge will be to work towards getting speedy environment clearances for the projects which are at present stuck.

http://articles.economictimes.indiatimes.com

EPC mode unlikely to boost highway sector

July 31, 2013

The decision of the Ministry of Road Transport and Highways to adopt the Engineering Procurement and Construction mode for building 20,000 km. two-lane national highways during the 12th Five Year Plan may fail to yield the desired results in the current state of the economy.

India, at present, faces a grave economic crisis due to low growth, high inflation, high fiscal deficit and highest ever trade and current account deficit. No doubt the slowing down of the global economy has had a significant impact on the country but the present economic adversity is largely attributable to domestic factors such as excessive monetary tightening, delays and uncertainty over key economic legislations, project delays on account of stalled environmental clearances and land acquisition hurdles, pause in reforms and lack of willingness to take decisions in the government.

“The decision of the MoRTH to adopt the EPC mode raises the question as to where the funds are going to come from in the prevailing economic scenario,” a source associated with the road sector told Projectmonitor.

“On one hand, the government is trying to cut costs by imposing various restrictive measures, and on the other, it adopts the EPC mode for construction of national highways. In case of PPP projects, even when viability gap funding is sought, the concessionaire meets minimum 60 percent of the cost. At present, the MoRTH is relying heavily on just EPC mode for meeting its targets but this may not be feasible in the long run because of various constraints. The focus, instead, should be on both modes, PPP as well as EPC, for boosting the highway sector,” he added.

The EPC mode is different from the conventional item rate contract. Unlike in item rate contract, which is prone to excessive time and cost over runs, the EPC mode assigns the responsibility of investigation, design and construction to contractors for a lump sum price awarded through competitive bidding with provision for index-based price variation.

In a bid to ensure smooth implementation of national highway projects under the EPC mode, the MoRTH, of late, has initiated a number of measures. Included among them is the decision to conduct review meetings for national highway works in respective states. Earlier, the review meetings with officials of state Public Works Departments were held in New Delhi. Under the new initiative, a month-wise schedule for holding the review meetings, starting from June 12th, 2013, has been worked out for the current year. The concerned Chief Engineers are required to convene review meetings for national highways and Central Road Fund works in states under their jurisdiction in accordance with the schedule.

Plans have also been drawn to organize training programmes covering the EPC mode of construction for state PWD officials, concerned officials in National Highways Authority of India and the MoRTH, consultants and contractors.

Source-http://www.projectsmonitor.com

Developers can’t use toll money to widen highways: Ministry

July 30, 2013

MAMUNI DAS

NEW DELHI, JUNE 8:

The Highway Ministry, while favouring a proposal to restructure premium paid by developers to the National Highways Authority of India (NHAI), has put in a few caveats.

In the tweaked proposal, the Ministry has suggested that the premium paid by a developer during the initial years cannot be lower than the toll revenue collected from that highway stretch. “The developer cannot use toll revenues to widen the highway,” said a source.

Premium is the amount offered by a developer to NHAI for the right to invest in widening a highway and collecting tolls from users of that stretch over a 20-30 year period. The annual premium offered was the bidding parameter for these developers.

Now, with changed economic conditions, many developers want to postpone the premium payment, which is termed as rescheduling of premium. The developers want to pay a lower amount in the initial years and a higher amount thereafter, while keeping the net present value of the premium constant.

So, as per the tweaked proposal, in the Kishangarh-Udaipur-Ahmedabad (KUA) case, where GMR is the highway developer, the annual premium cannot be lower than about Rs 400 crore, which is the level of annual toll revenue to be collected by the infrastructure major. In four-to-six-lane development projects, the developer collects toll from the time it starts widening the project. While no official confirmation was available, sources indicated that there had been discussions with developers, including GMR, on the issue, and the proposal was acceptable.

In the original premium rescheduling proposal, which was approved by the NHAI board, GMR had suggested that it would pay a very low level of premium in the first year of operations.

Another point is that the interest rate at which the net present value of premium is calculated will be linked to the Reserve Bank of India’s bank rate over the 20-30 year period. At present, the fate of this proposal – which will be sent to the Committee of Secretaries – is not clear. The Law Ministry has been opposed to any rescheduling of premium.

However, after this, NHAI Chairman R. P Singh sought “high level” intervention and an “informed decision” on the issue. He noted that not permitting rescheduling may jeopardise Rs 98,000 crore of potential premium committed by highway developers to the Government over the next 20-30 years, apart from leading to disputes.

Highway Ministry to speed up proposal to reschedule premium

July 30, 2013

MAMUNI DAS

NEW DELHI, MAY 22:

Facing a situation that may jeopardise the fate of many road development projects awarded two-three years ago, the Highway Ministry has decided to speed up its proposal to allow premium rescheduling.

The proposal will then be referred to an inter-Ministerial group headed by the Cabinet Secretary.

The Law Ministry has taken a stance against a proposal to permit deferment of premium payment for highway developers. The Highway Ministry had sought legal vetting of the proposal.

The Highway Ministry and National Highways Authority of India (NHAI) have favoured implementation of the proposal. “We will ask a Committee of Secretaries (CoS) to take a call on the issue,” said a source.

ROAD AHEAD

The future of some 26 road projects – where developers offered a premium of Rs 96,000 crore to the Government over the pre-defined concession period of 20-30 years – now hangs in balance.

Premium is the amount offered by a developer to the Government for bagging the right to invest in widening existing highways and collect toll from users over 20-30 years.

LESS REVENUE

The premium is payable annually and goes up by 5 per cent every year.

Many developers have expressed their inability to implement projects as the actual toll revenues end up being lower since the Indian economy entered a slowdown phase, leading to project cost escalation. They have approached NHAI and have sought staggered premium payment over the project life period.

The developers want to pay a lower amount in the initial years and higher amount in later years, while keeping the net present value constant.

FUND CRUNCH

Also, developers of about 30 projects awarded till early 2012 have not been able to tie up funds from banks and achieve financial closure.

Bank lending also got squeezed after developers directed banks to stop lending for road projects till 100 per cent land was available.

All these road projects were awarded on public-private partnership (PPP) basis, as the Government wanted to increase spending in sectors such as health and education.

However, as the economy slowed down, with the growth rate touching 5 per cent in 2012-13, investors stopped bidding for highway development.

In 2011-12, about 7,500 km of road development projects were awarded. In contrast, less than a 1,500 km of highways were awarded in 2012-13, with no response from bidders for several projects.

Govt likely to permit road developers to exit projects sooner

July 30, 2013

OUR BUREAU

NEW DELHI, JUNE 5:

A long pending proposal from highway developers seeking a relaxation of the exit clause – which allows an investor with deeper pockets to replace a promoter facing financial stress – may finally move forward.

A committee comprising Union Finance Minister P. Chidambaram, Planning Commission Deputy Chairman Montek Singh Ahluwalia and Highway Minister C.P. Joshi has agreed to a proposal to permit developers to fully exit any time after the financial closure for a project is achieved i.e. when a bank has given its funding commitment for a project. This will overrule the current time-based requirements that determine when a lead project developer can exit a project.

Earlier, the National Highways Authority of India (NHAI) had pointed out that banks should be allowed to replace a cash-strapped developer with a financially healthier substitute rather than declare the project a non-performing asset on its balance sheet.

This proposal had won the support of the Highway Ministry as well, which had felt that any developer unable to work on a highway development project should be allowed to exit as long as another firm is willing to take its place. The only condition fo this change will be that the replacement must meet the same technical qualifications.

To enable this change, the concession agreement between NHAI and developers will have to be altered, something which requires a Cabinet nod.

Meanwhile, another proposal to permit premium rescheduling is likely to be moved to a Committee of Secretaries. However, the final decision will be the Minister’s.

At present, Joshi is both the Railway and the Highways Minister. With a Cabinet reshuffle slated to be held soon, it is not yet clear which portfolio he will continue to hold.

Road projects: Exit norms can bring in funds, cut debt, say infra firms

July 30, 2013

V. RISHI KUMAR

HYDERABAD, JUNE 22:

Companies doing sizeable business in the infrastructure space have welcomed the Government’s move to bring in flexibility in the roads sector, including revised norms that permit stake sale in projects right after commissioning.

The move is expected to accelerate the rate of churn of projects, increase the size of disinvestment, bring about liquidity, aid in debt swap and infuse fresh equity into new projects.

R. Balarami Reddy, Executive Director, Finance, IVRCL, told Business Line that the decision will help accelerate the process of exits and give more flexibility to the developer.

EASING DEBT BURDEN

Until now, a developer of road projects under the National Highways Authority programme could divest up to 74 per cent stake in the project two years after the date of commissioning. The developer had to retain the rest during the concessional phase.

Now, the Cabinet Committee of Economic Affairs has permitted infrastructure companies to sell their stakes soon after the date of commissioning. This could be in tranches or for the entire project value , Reddy explained.

Sridhar Cherukuri, Chairman and Managing Director of Transstroy (India) Ltd , said, “These changes bring in flexibility to developers to divest stake and redeploy funds into new projects. We are at an advanced stake of concluding deals.”

T. Adibabu, Chief Operating Officer, Finance, Lanco Infratech Ltd, said the infrastructure sector has been waiting anxiously for regulatory changes as it would help infuse liquidity for developers.

“By disinvestment of stake in mature projects, companies can pass on debt to the buyer. It releases the promoter’s equity, which can be redeployed into new projects. The developer can strike new loan contracts, freeing up high-cost debt,” Adibabu said.

Several pension funds and overseas investors are keen to invest in completed road projects. The Government move will pave way for such investment. Internal rate of return on investments too will go up, he said.

‘A SETBACK’

M. Gautham Reddy, Executive Director of Ramky Infrastructure, said, “While the norms help in infusing liquidity, other critical elements relating to premium has been deferred. This is a setback. But for the buyer, it helps in gaining management control by taking up to 51 per cent stake.”

IVRCL had to re-negotiate and tweak a stake sale deal with TRIL, a Tata Group entity, for divesting stake in three road projects for Rs 2,200 crore, in keeping with existing divestment norms.

Companies such as Madhucon Projects, IVRCL, Transstroy, Lanco and NCC Ltd are all in the process of divesting stakes in completed projects.

The new highway

July 30, 2013

The NHAI must revert to the older model of funding projects and leaving construction to private players.

The Government’s move to allow developers of highways under the public-private-partnership (PPP) route the leeway to exit from projects immediately after they are commissioned will help infuse some liquidity into a sector where companies are struggling to raise funds. The majority of highway developers in India are contractors whose core strengths are in engineering, procurement and construction (EPC), and not in assuming the financial risks of operating and collecting toll from completed projects over a 20-30 year concession period. In contrast, are those investors with sufficient resources — from private equity firms to sovereign wealth funds — wanting to acquire road projects, but unwilling to take the risks of construction. By permitting developers to shed their entire equity, even in projects awarded on a build-operate-transfer (BOT) basis right after commissioning, the Government has essentially facilitated the sharing of risks — between those in a position to bear them until construction is complete and others only interested in managing the operational assets. In other words, a perfect fit.

The above ‘exit’ flexibility should, in fact, have been granted much earlier, ever since PPPs were made the preferred mode of executing highway projects. The shift to PPPs led to a situation where erstwhile EPC contractors, who undertook work on projects directly funded and bidded out by the National Highways Authority of India (NHAI), suddenly became full-fledged BOT developers. This was a job they were really not equipped for, made worse by onerous restrictions that forced them to stay invested right through the concession period of projects. In a scenario of high interest rates and tightening of lending norms by banks, the inability to divest stakes even in existing projects only compounded the liquidity problems of developers. The ultimate casualty here was the highway programme. With developers having no money to bid for new projects, the NHAI could award just 1,116 km of roads under PPP in 2012-13 as against 6,491 km the previous year.

Exiting from completed projects may help generate the much-needed liquidity for developers. But it will still not be enough to restore the kind of investor interest in highway development witnessed until a couple of years ago. The fact that a large number of PPP projects bidded out in 2011-12 are yet to achieve financial closure highlights the seriousness of the crisis in the sector. For the time being, the Government has little option but to go back to the older EPC model where the NHAI funded the projects and handed out construction contracts to private players. If nothing else, it will keep the highway building programme going and inject liquidity amongst contractors who may be enthused to bid for PPP/BOT projects as and when the overall economic situation improves. The NHAI must be made to speed up its process of awarding EPC contracts and the Government should untangle the regulatory thicket — particularly, in the environmental sphere — coming in the way of project implementation.