Government has to open purse-strings to get new highways off the road

December 24, 2015

Warning: Undefined variable $thumb in /var/www/web/indiantollways.com/wp-content/plugins/digg-digg/include/dd-class.php on line 887

7,500 km at completion risk, trend shifts to govt-funded format.

The road sector is being widely touted as the only glimmer of hope in a bleak core sector narrative, but the numbers tell a different story

On December 2, creditors of Hyderabad-based road developer IVRCL Ltd decided to convert their loans to the company worth Rs 7,500 crore into a majority equity holding. The lenders, led by State Bank of India and IDBI Bank Ltd, invoked the strategic debt restructuring (SDR) provision that allows banks to take over the management of a firm after converting debt into equity in cases where debt restructuring has failed or is near failure.

In August, Gammon Infrastructure Projects Ltd agreed to sell six roads among nine infrastructure projects to BIF India Holdings Pte Ltd for Rs 563 crore, taking advantage of a newly introduced regulation to ease the exit of developers of operational road projects. On November 23, Gammon India Ltd’s lenders decided to invoke the SDR norms and convert a part of its Rs 15,000-crore debt into majority equity.

The road sector is being widely touted as the only glimmer of hope in a bleak core sector narrative, but the numbers tell a different story. An estimated 7,500 km of highway projects have been deemed to be at high risk of not being completed, including 5,100 km under construction and 2,400 km of operational sections that were awarded mostly between fiscals 2010 and 2012 on the Build, Operate, Transfer (BOT) format.

Estimates prepared by the research arm of rating agency Crisil show that of the projects under construction that are at high risk, around 50 per cent are due to significant cost over-runs and weak wherewithal of sponsors.

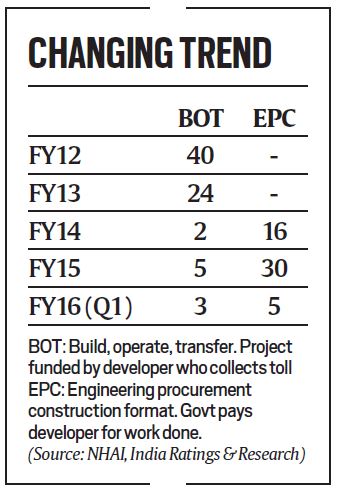

Finding it difficulty to award Highway sections to private developers, the roads ministry has resorted to a sharp shift from the BOT model to the government-funded Engineering Procurement Construction (EPC) format. The EPC model is less capital-intensive and the developer is largely insulated from the traffic risk — the government makes the payment and the developer’s responsibility ends with delivering the completed project.

Under the BOT model, where the developer funds the project and earns returns from toll collection for the duration of the concession, the capital is locked in for a long period with the risk of revenue not adequately covering for construction and debt servicing costs. Road Transport and Highways Secretary Vijay Chhibber told The Indian Express that about 80 per cent of road projects are being offered under the EPC route currently, with BOT and hybrid annuity accounting for the rest. “As the market changes, we will increasingly move away from EPC and in favour of hybrid annuity and BOT,” he said.

The hybrid annuity model is a mix of the EPC and BOT models, where the road authority will provide an initial grant of up to 40 per cent of the cost with the developer chipping in with the rest and completing the project. Data from India Ratings and Research — a unit of Fitch Ratings — shows that 21 highway projects worth Rs 26,000 crore failed to attract bids over the last two fiscal years.

As a result, the National Highways Authority of India (NHAI) had to fall back on EPC contracts to plug the gap — from nearly an all-BOT road model during 2008-09 and 2012-13, the share of BOT dipped below 15 per cent in 2013-14 and 2014-15. For instance, out of 7,980 km length of national highways awarded during the last year, just 700 km had gone on public private partnership mode and the rest were all EPC projects. But even if a large-scale shift to EPC were to happen, there are bound to be tremendous constraints on funding. A parliamentary panel review report in December flagged that NHAI was able to spend only Rs 6,208 crore out of Rs 23,691.8 crore, or about 26 per cent, allocated during 2014-15 at the Revised Estimate stage (in the budget for 2015-16).

The official contention of the roads ministry, though, is that during 2014-15, the NHAI recorded total cash outflow or expenditure amounting to Rs 23,696.19 crore and that the company actually used borrowings amounting to Rs 2,876.40 crore to bridge the gap between resources from the government and its cash outflows.

While there seems to be some pickup in project awards, the outlook for under-construction projects is turning more bleak. “Under-construction projects require equity and cost-overrun support of around Rs 28,500 crore over the next two years. Of this, about Rs 16,000 crore could be stumped up from internal accrual of sponsors and sale of stake at the special purpose vehicle level. That leaves a significant shortfall of Rs 12,500 crore,” said Sudip Sural, senior director, Crisil Ratings, who worked on the roads sector report.

On the issue of projects awarded between 2010 and 2012 being at a high risk of not being completed, Chhibber admitted that the government has worked hard to work a way around the legacy issues that were dogging progress of road projects. “The real gamechanger is the recognition within the government that we may have also contributed to the languishing projects, in terms of delays in clearances and land acquisition. So, we’ve taken a decision that to the extent that the delay is on account of such factors, we will compensate the developer. This is a major policy shift… the acceptance of the fact that the government has not met its side of the bargain,” he said. He also said that in some cases, the concessionaire may have taken out more money out of the project and is now not interested in its completion.

In such cases, Chhibber said the ministry will not stop short of taking action against developers, “even to the extent of cancellation of contracts”. Atul Punj, chairman, Punj Lloyd Ltd, a construction services player in the infrastructure sector, told The Indian Express that while there was an uptick in the highways and the power transmission sectors, most other infrastructure segments were still struggling. According to him, the clubbing of the construction sector within the overall infrastructure bracket for funding purposes was undermining the recovery. This is more so, he said, because banks were at the upper end of their limits on lending to the infrastructure sector, leaving the construction sector, which shoulders the primary load of setting projects into motion, badly hamstrung.

Pending disputes: Rs 25,000 crore Disputes are another issue that are hampering the completion of road projects. Data from the road ministry shows that 112 cases involving Rs 25,000 crore were pending under arbitration between the NHAI and developers till end-April 2015. The disputes are typically accompanied by lengthy arbitration, something that private players feel drains them badly. Added to this is the fact that an underdeveloped bond market has forced PPP road projects to mainly depend on debt from commercial banks, something highlighted by the Reserve Bank of India Governor Raghuram Rajan, who cautioned banks of their high exposure to the sector and underscored the need to deleverage.

By February 2015, the total deployment of gross bank credit in the road sector was Rs 1.67 lakh crore, 384 per cent up from FY08. The infrastructure sector was identified by RBI, in 2013, as one of the five sectors with a high level of stressed advances. Wooing investors Apart from the hybrid annuity model, introduced for projects granted from October 1, 2015, the government has been looking at other ways to boost investor appetite.

In August 2015, the Cabinet Committee on Economic Affairs cleared a proposal to allow infrastructure companies — essentially in the road sector — to divest 100 per cent of their equity after two years of completion of construction for all projects given as per the BOT model, irrespective of the year the contract was handed out. This was to allow companies to use the funds from the sale of equity to invest in other projects as well as repay their debts. But road developers say it’s tough to hold on to the asset for even two years after completion of construction, as the debt goes up because of cost escalations due to inordinate delays for land and other clearances, legal disputes and arbitration proceedings. The solutions, according to a Maharashtra-based private developer, are far from optimal.

Sources: Indian Express

One comment on “Government has to open purse-strings to get new highways off the road” Post your comment

how do i make money on the internet…

Government has to open purse-strings to get new highways off the road : Indian Tollways…